|

Risk Free College Planning, Retirement Planning, Estate Planning,& Financial Protection

Click Below for More Information

Medicare |

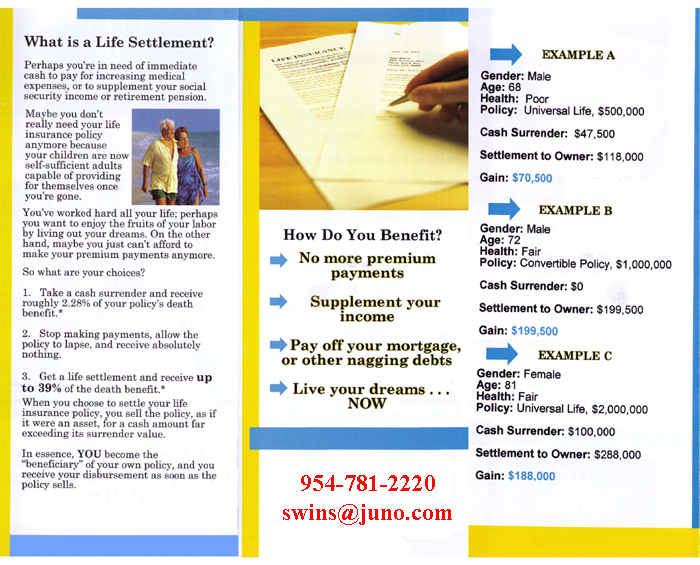

Life Settlements

( Life Insurance Policies can be a significant source of cash)

Don't Lapse your policy and walk away. Sell it and keep it's value for yourself

When Should You Consider Selling Your Life Insurance Policy?

Policy ready to lapse or likely future surrender |

Retirement cash needs |

Cannot afford premium payments |

Family Issues |

Children raised and gone - no longer need |

Need for different coverage |

Death of Beneficiary |

Health deteriorated & need cash |

Sale of Business that held policy Divorce or bankruptcy |

Need for cash to fund long term care,

supplemental health care or an annuity |

Who Is Eligible?

Age 65 and older with significantly deteriorated health |

Policies with death benefit over $100,000 |

Permanant policies and convertible term policies |

Policies that have been in force at least 2 years |

|

Questions to Ask Yourself

• Have your family circumstances changed? |